‘I’ve never seen as much demand globally for fine wine as now, because there are just so many fine-wine lovers.’ So says Adam Bilbey who has just made a relatively unusual move from the wine department of Sotheby’s to that of Christie’s, becoming their global head of wines and spirits. Significantly, Christie’s have decided that he should remain in Hong Kong, where he has been based since 2010, initially working for Berry Bros & Rudd.

As many will know, in this pandemic-limited era Hong Kong has become increasingly isolated. Travelling anywhere else, and returning, is effectively impossible for a busy executive. Compulsory universal testing was announced on Monday. Restaurants are currently closed from 6 pm and may serve a maximum of two diners, and for the first time household mixing is severely curtailed – no more than two households at a time – although according to Bilbey, wine drinking at home is at an all-time high. Jo Purcell of Farr Vintners, with the longest track record of the many representatives of London wine merchants in Hong Kong, reports recycling bins in residential districts overflowing with wine bottles in record profusion.

A further blow for the 1,300 wine traders who have played a part in making Hong Kong a global hub of the wine trade after wine duty was deliberately reduced to zero in 2008 is that the borders with Macau and mainland China have been closed. Until recently massive quantities of wine sold in untaxed Hong Kong found their way over the border into the heavily taxed mainland. And the casinos of Macau were traditionally major buyers of some of the finest bottles.

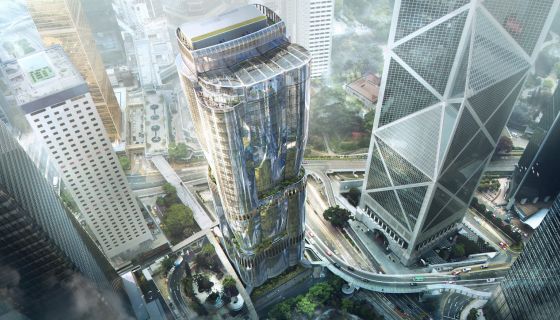

So why have Christie’s, once the world’s leading wine auctioneer but in 2021 considerably behind long-standing rivals Sotheby’s, whose own annual sale total is now way behind those of American auctioneers Acker Merrall & Condit and Zachys, decided to base their wine department in Hong Kong, investing in lavish new premises (illustrated above) for it?

According to Bilbey, it’s because Asia is where the most serious wine buyers are. At least 60% of Sotheby’s wine and spirits sales are usually to Asian buyers, although that proportion dipped to 52% last year. (Jamie Ritchie, Sotheby’s head of wine, points out that this was almost certainly the result of introducing two new charity sales, the Hospices de Beaune and the Distiller’s One-of-One auctions, which attracted more European buyers than usual.) So presumably Bilbey’s address book is of particular interest to Christie’s.

Already 40 to 50% of Christie’s wine sales globally are to buyers in Asia, not just Hong Kong and mainland China but, developing fast, also Thailand, Vietnam, Indonesia and the Philippines – as well as the established wine market Taiwan, whose current wine scene Bilbey describes as ‘even crazier’ than the one in Hong Kong. He compares Hong Kong pre-pandemic dining habits to the first few years of this century in New York, when meals devoted to drinking really rare, expensive wines with groups of fellow enthusiasts were a big thing.

Such conviviality may have been seriously affected by COVID-19 restrictions but according to Bilbey, ‘Asians are very different from European wine buyers. The curiosity and sharing tendency of top Asian collectors is amazing. You often find 12 people round a table and might see them sharing 20 different bottles because everyone wants to compare and contrast. It’s amazing how keen they are to learn – and not just about the classic wines. The knowledge they have can make me feel so stupid sometimes.’

The European tradition is to buy fine wine young and cellar it perhaps for decades until it’s judged to be mature. But in Asia there’s an impatience to press the fast-forward button and open even the greatest wine much earlier than has been the norm.

The result is pressure on the supply of fine wine available and, of course, on prices. This phenomenon, together with the pitifully small quantities of top burgundies produced and the sheer number of wine-loving billionaires in Asia, has been largely responsible for the recent extraordinary escalation of burgundy prices.

Top-grossing wine auctioneer Acker is based in New York but also has a major presence in Hong Kong. While 45% of Acker’s sales in 2021 went to North Americans, 32.4% went to Asians and just 17% to European buyers. (Acker’s annual report identifies a whole new market: Russia overtook Brazil to account for 2% of sales last year.)

In the West the people who are determined and sufficiently well-off to get their hands on trophy wines tend to be pretty senior. Not so in Asia where young collectors ‘have the funds and want to learn’, according to Bilbey, who told me that several important Asian buyers he knows are in their mid 20s. He cited a 24-year-old now based in Guangzhou who’d got into wine while studying in Europe when 18. ‘The knowledge he has of burgundy is exceptional. People like him think that if you’re going to drink, you’re going to drink well.’ In Christie’s recent Luxury Market Report is the statistic that 24% of their wine and spirits sales last year went to millennials.

There’s a massive difference between how wine is auctioned by the American auction houses and their traditional British counterparts. The Americans often conduct their fine-wine sales in top restaurants so that the experience is both gastronomic and glitzy. Compare and contrast with a typical morning sale in a nearly empty, sober sale-room in central London, no matter how historic the building. Bilbey admits he needs to jazz things up a bit.

Sale-room turnover must have been considerably affected by the recent development of online trading platforms for customers of the many wine merchants and traders who now encourage their customers to buy and sell wine among themselves. Bilbey gamely says that Christie’s are content to leave the exchange of young vintages to the merchants and that he sees his job as sniffing out superlative single-owner collections of older wines. But he admits that ‘the scrabble [between auctioneers] to get collections is furious’. Presumably it all depends on what the auction house can promise a seller. ‘To sell a collection well’, he adds, ‘you have to understand what the collector’s motive for selling is. Sometimes it’s financial. Sometimes it’s a question of legacy – people just have too much wine. Sometimes people want to create a lasting memory and for them a lavish printed catalogue is necessary – even if it’s not the best thing for the planet.’

As with pretty much all auctions, activity is moving online, although last year only 10% of Acker’s sales were internet-only rather than at a live auction.

But the possibility of online bidding, even at a live auction, means that more and more Asian buyers are pushing up prices at auctions all over the world. Asian, as opposed to European or American, collectors think nothing of snagging a particularly desirable lot at an auction in, for example, Los Angeles or Geneva. They will then have the wine shipped to join the rest of their wine collection, which could well be in the UK or Bordeaux (where there is now no shortage of specialist wine storage), with fees typically much lower than in Hong Kong where there is such a shortage of land.

As fine-wine prices rise, so does the temptation to produce fakes – especially in the less mature markets of Asia. Acker was closely associated with the notorious wine counterfeiter Rudy Kurniawan, who recently spent 10 years in an American jail before being deported. For some years there has been a market for empty bottles of trophy wines that can be refilled with much cheaper stuff. Some knowledgeable wine drinkers and producers deliberately spoil labels once they have consumed the contents of a valuable bottle. And many producers whose wines are in most demand discreetly adopted anti-counterfeit measures some years ago (although of course these protect only younger vintages).

Apart from minute inspection of design and typefaces on labels, foils and bottles, a paper (possibly to be superseded by a blockchain) trail of provenance is invaluable. Bilbey’s advice to anyone thinking of selling their fine wine at auction is ‘keep your records; we need them’.

Wine is by no means the only alcoholic drink achieving sky-high prices at auction now though. It is no accident that Bilbey’s job spec also includes spirits. Demand for older, rarer whiskies is also at an all-time high, with a high proportion of successful buyers coming from Asia, even if in Hong Kong demand is dampened by the fact that local tax on spirits is not zero but 100% of value.

Times may be a bit difficult currently in both Hong Kong and mainland China but both Bilbey and Purcell are confident of the long-term future for wine sales. ‘We haven’t really scratched the surface of China’, according to Bilbey. ‘There’s huge potential for fine wine there.’ And for Purcell, ‘Asia is resilient’.

A possible fly in the Chinese ointment

Jo Purcell of Farr Vintners points out that a new regulation that came into force in mainland China last April may have considerable consequences for wine. The regulation stipulated that producers of food products (which now include wine) imported into China needed to be registered and approved by China Customs by 1 January 2022. The relevant registration portal was launched only in October 2021 and only in Chinese. A test English version was launched in November. The requirement is that any château or domaine has to complete complex online forms about themselves as well as their ‘manufacturing process’ and storage of the product, along with photographic evidence.

Once approved, the producer is to be issued with a unique number which should then be printed on a label to feature on the bottle and also on the outside of all cases of that producer’s wine. According to Purcell, many producers were either unaware of this or are not interested in registering – especially if their wine is in great demand anyway. There have been rumours, but no official confirmation, that the 1 January 2022 deadline has been extended, so importers are worried that they may face major problems with customs clearance.

When Purcell checked in early February, none of the top French wine producers had been issued with a registration number. ‘If this legislation is enforced it will have a dramatic impact on the range of fine wines that are imported officially into the mainland’, predicts Purcell.

Major fine-wine auctioneers

US

Acker Merrall & Condit

Zachys

Hart Davis Hart

Heritage

UK

Sotheby’s

Christie’s

Bonhams

Europe

Baghera (Switzerland)

IdealWine (France)

Sylvie's (Belgium)

See our guide to auctioneers and auction tips.