It’s amazing how quickly unthinkable scenarios can become entirely normalised. I refer to the price of wine in Asia, of course. As I noted when I first moved here, wine in Singapore is routinely two or three times more expensive than the prices I was used to in the UK. Yet now, nine months later, those higher prices no longer seem so outrageous to me.

Examining why that should be invokes wine’s most subjective characteristic: value for money. By firstly analysing some figures in a case study, we can start to consider the reasons prices might differ. Then, we can assess the influence of economic, social and cultural factors before finally considering what constitutes value in wine.

The prices are right?

The graphic below illustrates how much price can vary, using one of my all-time favourite reds, Guigal’s Côtes du Rhône. With basic maths, we can investigate why wine prices can vary so greatly around the world.

Note: the data originally comes from Wine-Searcher using the lowest available price (including tax) in US dollars. Some of the prices are disputable, but overall the price trend looks about right. Throughout this article, I have converted all prices into US dollars, quoting the GBP and EUR equivalents.

The median price for Guigal Côtes du Rhône in Asia is $20.88 (£17.02/€19.32) per bottle, which is 57% more than the equivalent for the EU and the UK, where it averages $13.30 (£10.84/€12.31).

Why should it be so much more expensive in Asia? The main economic factors which might explain the disparity are taxes, margins, volumes, and the influence of supermarkets.

Economic influence: taxes

Duty and tax is one of the wine trade’s favourite bugbears, and a significant difference in taxation explains some of the lowest and highest prices in the Guigal graph.

Duty in France is a nominal $0.38 (£0.31/€0.35) per nine litres of wine. Including their prevailing VAT of 20%, that equates to $0.038 (£0.031/€0.035) per bottle, which is 0.47% of the bottle price of $8.07 (£6.58/€7.47).

Duty in Singapore is $61.17 ($49.84/€56.62) per litre of pure alcohol. Including GST at 7%, that works out at $6.87 (£5.60/€6.36) per bottle, which is 27% of the bottle price of $25.20 (£20.54/€23.32).

The proportion of duty is 57 times higher in Singapore than in France, yet the retail price is ‘only’ just over three times higher – plus in France, shipping costs will inevitably be lower than in export markets. Clearly, tax is not the whole story in determining wine prices around the world.

Economic influence – margins, volumes, and supermarkets

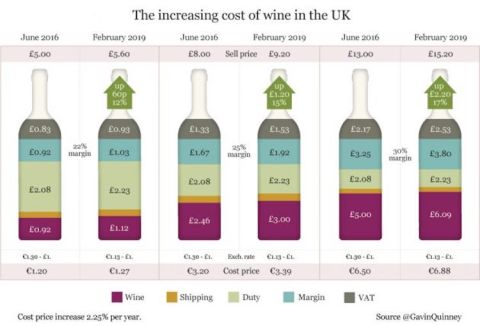

Another way to crunch the numbers is to estimate the margins involved. A good guideline for this is Gavin Quinney’s calculations of how the cost of a bottle is apportioned. (Note: in this model, shipping is set as a fixed $0.27 (£0.22/€0.25) per bottle).

According to this example, we can work out that the French bottle costs $7.76 (£6.34/€7.18) after duty and shipping. Assuming a retail margin of 25%, that indicates a supplier price of $6.20 (£5.06/€5.73).

In Singapore, a $25.20 (£20.58/€23.30) bottle leaves $18.06 (£14.75/€16.70) after duty and shipping. Assuming the same retail margin, that indicates a supplier price of $14.45 (£11.80/€13.36).

That suggests that the supply chain is making 2.3 times more profit in Singapore than it does in France. However, economies of scale are vastly different. According to OIV statistics, France had a per-capita consumption of 51.2 litres of wine in 2016 whereas Singapore had only 2.66 (but I’m working on it).

Furthermore, that assumption of a 25% retail margin in Singapore is a big one. My experience in the trade here is that margins are much higher – at least 50% if not more, in some cases. Elsewhere, Guigal’s Polish importer is apparently ‘margin-hungry’, while Robert Joseph argues that wherever supermarkets dominate wine sales, margins are generally forced down.

Social, societal and cultural factors

Analysing taxes and margins doesn’t result in a reliable formula to explain why wine prices vary in different countries – which brings us to the equally important role of local, non-economic factors.

For example, one suggestion is that the level of wine knowledge within a population determines how much retailers can get away with charging. But that doesn’t stand much scrutiny – the wine-drinking population of Singapore is no less knowledgeable than that of France, and is arguably more so (again, I’m working on it).

However, because wine is not culturally native to Asia, and because consumption volumes are so much lower, its affordability is not considered as essential as it is in France. Then there are economic considerations such as inflation, cost of living and average earnings, all of which come to bear on wine pricing – but none of which I have the space or expertise to go into.

Baulk-buying: what constitutes value in wine?

When I first arrived in Singapore, I baulked at spending SG$26 (£14.75/€16.70/$18.07) on a bottle of Portuguese white wine such as this, but with time that has come to seem reasonable in the local context. Not only that, but it makes UK prices seem unsustainably low – a not uncommon complaint among the UK wine trade.

Vinous value for money is ultimately a matter of opinion. In some circumstances, a £300 bottle of premium Napa Cabernet can be good value. Looking at prices from an Asian perspective reminds you that cheap wine isn’t a basic human right, and that keeping prices low isn’t necessarily a sustainable strategy.

Wherever you drink wine, discovering the best-value buys remains an important quest. The very best bargains are often elusive: just 2.5% of our nearly 200,000 tasting notes are tagged GV for good value – but at least that gives you 5,000 options to start with.