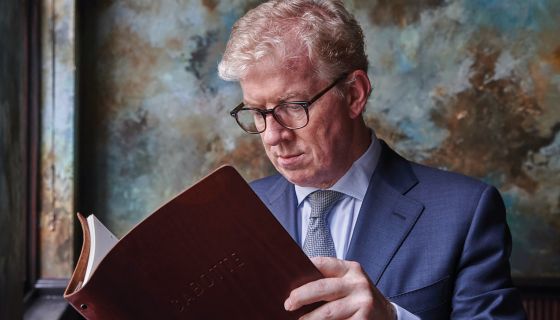

4 November 2020 We are not great fans of buying wine for investment but the story of Ian Mill QC (pictured above studying the wine list at Cabotte), about whom we wrote in The collecting instinct, may tempt you.

My story with wine began in February 1985 at Le Manoir aux Quat’Saisons, a two-Michelin-starred restaurant near Oxford. The bottle chosen that day by my much more knowledgeable companion was a grand cru white burgundy from the great 1982 vintage, Domaine Leflaive’s Bâtard-Montrachet. The experience, from first smelling and tasting it through to the last sip, was revelatory, extraordinary. As the meal wore on, a realisation dawned and took shape, that my life was taking a new and exciting turn. When I walked into that restaurant, wine was just wine and the anticipation lay in the quality of Raymond Blanc’s cuisine. When I emerged, there was an absolute determination to find other such bottles and to drink them. This proved to be the start of what has been a fabulous 35-year journey (so far), driven by an unwavering passion for drinking and, ultimately, collecting great wines, from Burgundy and elsewhere.

There was a steep learning curve. In the first instance, I engaged with sommeliers, read voraciously and frequented a wine shop in Pimlico that was run by a regular cricket opponent, force of nature and expert on the wines of Burgundy by the name of Jasper Morris MW. Jasper suggested wines that would expand my knowledge and fuel the passion – mostly burgundy, but also Chardonnays and Pinot Noirs from the New World. At this point I was buying wine purely to drink. That changed in the 1990s when I had become a shareholder in Morris & Verdin, Jasper’s wine company.

These were heady times. The AGM was an excuse for a wine dinner at which Abigail, Jasper’s wife, would cook a feast for the 20-odd friends of Jasper who had become his fellow shareholders. There were also dinners attended by Jasper’s Burgundian producer friends where everyone brought and shared great bottles. I recall on one such occasion seeing Dominique Lafon literally swinging from the rafters high above us, confident that I was about to witness the demise of one of Burgundy’s greatest talents, while Jasper looked on unconcerned proclaiming the consumption of his hundredth wine of the evening.

This was also a period when greater experience, opportunities and confidence resulted in increasing numbers of purchases. I was also forging relationships (which remain unbroken today) with some of the greatest producers of burgundies and many of the top UK wine merchants. However, I continued to delude myself that I was going to enjoy each such bottle. I did not allow myself to contemplate wine as an investment. I was a drinker, pure and simple.

The blinkers finally came off in the early 2000s when Jasper decided to sell Morris & Verdin to Berry Bros & Rudd and the fine-wine team at BBR started opening my eyes to the investment opportunities that fine wine represented. During that decade, the value of the top bordeaux releases burgeoned as the Chinese entered the market. A little later, they discovered the joys of great burgundy. This coincided with a recognition on my part that my traditional pension investments were going nowhere fast.

My bordeaux purchases through BBR were all sold by me once the market for those wines had peaked in 2010 (the Chinese had by this point become somewhat more prudent in their acquisitions), and I focused my attentions on building the greatest possible burgundy collection to sell at auction in due course. I would receive about 50 offers a day from the UK trade. At least one a day would result in a purchase. I had very clear principles – to buy only the best wines in perfect condition from the best producers and only from the best vintages. There was one additional criterion, necessary to make my collection a purely personal one: I had to like the wine. There are many lauded producers whose wines do not appeal to my palate. Those wines found no place in my cellar. This reflected my continuing view of myself as primarily a lover and consumer of fine wine.

Two final highlights to date. First, my friendship with Master Sommelier Xavier Rousset (initially through the 28˚-50˚ wine-focused restaurant group) has led me into becoming a restaurant owner. Xavier decided five years ago to start a restaurant that focused on the wines (and food) of Burgundy, and asked me to get involved, along with other shareholders who include a dozen Burgundian producers. Cabotte in the City of London opened four years ago and has been thriving since, with a truly outstanding burgundy-focused wine list (including some bottles from my collection).

Secondly, an auction of a significant proportion of my collection took place in New York last October under the auspices of the wine-auction specialists Zachys. This was an extraordinary experience for me – sitting in the private dining room of Le Bernardin in mid-town Manhattan, eating Michelin-starred food accompanied by bottles from my collection while, all around me, people who shared my passion were vying to buy bottles which I had acquired for just this purpose. The sale was a great success – 100% of the lots sold and often at world-record prices.

I was asked frequently at the time of the auction whether it saddened me to be parting with my collection. My genuine answer was always the same: not at all, those wines had been bought for that purpose and I had (and have) plenty left to enjoy in the future.

Favourites

I have been asked which are my top purchases. My definition of top purchases extends beyond pure investment return. It has to embrace the experience of shared consumption as well. So I would definitely nominate the cases of wine which I shared with 60 friends and family when I turned 50. One was Rousseau Chambertin 1990 which I bought for £390 in 1992, and was worth in excess of £20,000 when consumed. The other was a case of magnums of Bonnes Mares, Vieilles Vignes 1988 from Christophe Roumier. Christophe only ever made a Vieilles Vignes as a separate cuvée on this one occasion. He may have bottled only two cases of this tiny production in magnum. I bought my case in about 2005 for £4,000. A second case of magnums sold at auction a few years ago, for $150,000. Both wines were magnificent.

I would also nominate another pair of wines, this time consumed with a smaller group of friends, to mark my 60th year. A pair of magnums, both Rousseau, both 1971. The Chambertin and the Clos-de-Bèze. These sat for many, many years in my home cellar, bursting with evident quality and screaming to be drunk. I have never seen or even read of the existence of another magnum of either wine. They were perhaps the finest pair of wines of my life. Dirt cheap when acquired, priceless when consumed.

There was also a barrel of Meursault Genevrières 2012, bought at the Hospices de Beaune auction and made for me by the incredible Benjamin Leroux. I have shared this extraordinary wine with many people, including at my auction last year. I auctioned a six-litre bottle of it on that occasion. It sold for seven times its estimate.

Tips for investors

I would not want to leave the reader with the impression that anyone can generate, and sell for profit, a wine collection over a period of 10 to 15 years which is what, in bare outline, I did. There were in my case a number of key background elements which made this possible. First and foremost, a passion for wine which enabled me to acquire a deep knowledge of the subject and which gave me the drive to spend countless hours weighing up investment offers.

Second, the long-standing relationships and, in many cases, friendships with those who made me those offers. Great burgundy is made in tiny quantities and demand massively outstrips supply. When I was offered an opportunity to acquire a great bottle, it was because the person who offered it chose me as its recipient. Third, the importance of timing. My investments have benefited hugely from the upsurge in the value of fine burgundy during the period of my investment, caused in no small part by the entry into the market of the Chinese investor. As I mentioned above, the market for bordeaux peaked some 10 years ago. The market for burgundy is likely to remain much more resilient because of the crucial element of scarcity. Bordeaux (even at the top end) is made in vastly greater quantities. So, passion, patience and selection are the key ingredients.

I have also been asked whether I invest in anything else. Absolutely not. No other commodity generates anything like the necessary passion in me.